| aa | Check out the funds

Take some time to review the investment options listed below to determine which funds you might like to invest in. Before you choose an investment option, we recommend you complete the Investor Strategy Worksheet to determine your investor style. You can access this worksheet online during your enrolment, or by following the procedure indicated at the bottom of this page after you enroll.

Investment Option A: Target Date Portfolio

To help make investment selection simpler for you, Air Canada offers well-balanced Target Date Portfolios.

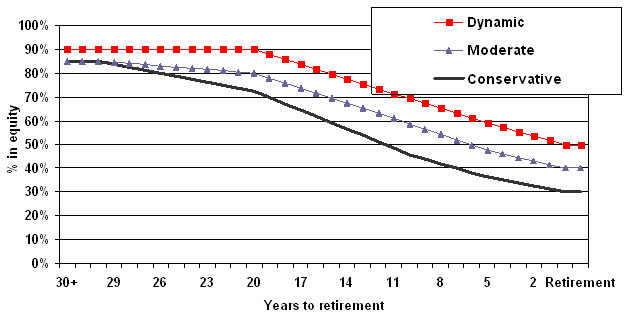

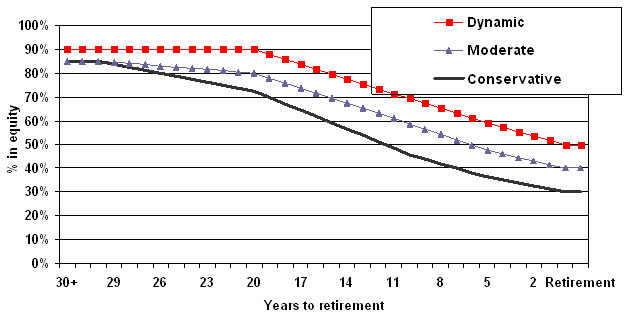

Portfolios are offered with three (3) levels of risk, one for each investor style: conservative, moderate or dynamic. Each portfolio is based on an expected date of retirement. The portfolios invest in a diverse range of funds intended to offer growth potential through different market cycles.

Simply determine your investor style and the year you plan to retire, and the portfolio's composition will be managed for you. As you get closer to your planned retirement date, the asset mix inside your portfolio is rebalanced automatically to become more conservative.

Click here for information on the portfolio composition.

The portfolio code starts with the letter P, followed by your retirement year, then a letter that corresponds to your investor style (Conservative = V, Moderate = X, Dynamic = Z).

For example, if you plan to retire in 2032 and are a conservative investor, your portfolio code is P2032V. |

Other investment available to you if you choose a portfolio

In addition to your portfolio, you may wish to invest a portion of your savings in the:

- MLI 5 Year Guaranteed Interest Account – code 1005

You can not select any other investment fund if you select a portfolio. Only one portfolio can be selected at any time.

Investment Option B: Build Your Own Portfolio

If you prefer to build your own portfolio, you can do so by choosing from the investments below. It is important to determine your investor style first, using the Investor Strategy Worksheet and ensure you select investments that suit your style.

Click here to find sample asset allocations that fit different investor styles.

Tips to help you:- Each asset class is colour-coded according to the asset class it represents. This makes it easier for you to see if your fund selections provide you with a diversified mix of asset classes.

- To learn more about a fund, select the fund name to read the fund description, commentary and review. Click here for help with reading these fund descriptions and tips for understanding the data contained on them.

|

Manulife Canadian Money Market Fund (MAM) (3132) Manulife Canadian Money Market Fund (MAM) (3132)

Guaranteed Interest Account 5-year (1005) Guaranteed Interest Account 5-year (1005)

Manulife Asset Management Canadian Bond Index Fund (4191) Manulife Asset Management Canadian Bond Index Fund (4191)

Manulife BlackRock Long Bond Index Fund (4322) Manulife BlackRock Long Bond Index Fund (4322)

Manulife FGP Small Cap Canadian Equity Fund (7381) Manulife FGP Small Cap Canadian Equity Fund (7381)

Manulife GE Asset Management Canadian Equity Fund (7761) Manulife GE Asset Management Canadian Equity Fund (7761)

Manulife BlackRock U.S Equity Index Fund (8322) Manulife BlackRock U.S Equity Index Fund (8322)

Manulife Sprucegrove International Equity Fund (8361) Manulife Sprucegrove International Equity Fund (8361)

Manulife Sprucegrove Global Equity Fund (8362) Manulife Sprucegrove Global Equity Fund (8362)

Manulife JP Morgan Emerging Markets Fund (8432) (You can allocate a maximum of 10% of your assets to this fund.) Manulife JP Morgan Emerging Markets Fund (8432) (You can allocate a maximum of 10% of your assets to this fund.)

Click 'Access your account' to review the rates of return and investment management fees (IMFs)* for the funds available through the Air Canada Retirement Program. These rates of return represent past performance and cannot guarantee future results.

*Investment Management Fees are collected by Manulife Financial to cover the cost of investment management and fund operating expenses. IMFs for the RRSP also include a charge for administrative costs and the fee is deducted from the fund before unit values are calculated. The administrative costs are paid by Air Canada for the DC plan

Need help choosing your investments?

| Manulife's licensed Financial Education Specialists can assist you from Monday to Friday, 9 a.m. to 5 p.m. ET at 1 888 727-7766. |

To determine your investor style:

1. | Click on 'Access Your Account' from the left-hand menu and log in using your email and password. |

2. | Once logged in, select a policy number from the list. Menu options will appear on the left hand side of the page. |

3. | In the 'Change My Investments' section, click on 'Investor Strategy Worksheet'. By completing this worksheet, you will find out what type of investor you are and can proceed to select funds to match that style. |

To select or change your funds:

Existing investments

1. | Click on 'Access Your Account' from the left-hand menu and log in using your email and password. |

2. | Select a policy number. Menu options will appear on the left-hand side of the page. |

3. | From the 'Change My Investments' section, select the 'Transfer Between Investments' option and follow the prompts that appear. |

Future contributions

1. | Click on 'Access Your Account' from the left-hand menu and log in using your email and password. |

2. | Select a policy number. Menu options will appear on the left-hand side of the page. |

3. | In the 'Change My Investments' section, select the 'Change Future Investment Instructions' option and follow the prompts to select or change your funds. |

|

Manulife Canadian Money Market Fund (MAM) (3132)

Manulife Canadian Money Market Fund (MAM) (3132) Guaranteed Interest Account 5-year (1005)

Guaranteed Interest Account 5-year (1005) Manulife Asset Management Canadian Bond Index Fund (4191)

Manulife Asset Management Canadian Bond Index Fund (4191) Manulife BlackRock Long Bond Index Fund (4322)

Manulife BlackRock Long Bond Index Fund (4322) Manulife FGP Small Cap Canadian Equity Fund (7381)

Manulife FGP Small Cap Canadian Equity Fund (7381) Manulife GE Asset Management Canadian Equity Fund (7761)

Manulife GE Asset Management Canadian Equity Fund (7761) Manulife BlackRock U.S Equity Index Fund (8322)

Manulife BlackRock U.S Equity Index Fund (8322) Manulife Sprucegrove International Equity Fund (8361)

Manulife Sprucegrove International Equity Fund (8361)